Watertown’s residential property tax rates will rise less than one percent for people whose primary residence is in Town. This was due to the growing value of commercial properties, the increase of the residential exemption, and continuing the practice of shifting the burden onto commercial, industrial and personal property (CIP).

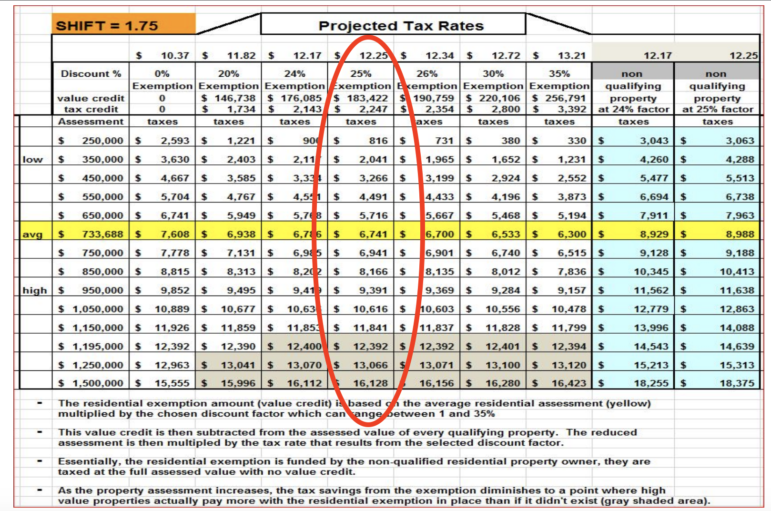

Tuesday night, the Town Council approved the property tax rates for Fiscal Year 2021, including an increase of the residential exemption from 24 to 25 percent. The rate will be $12.25 per $1,000 of assessed value, which is 11 cents or 0.98 percent higher than FY2020.

Town Assessor Earl Smith said that there is still room for the residential exemption to increase up to 30 percent. Town Council President Mark Sideris said that the additional residential exemption could help taxpayers if and when the high school project is approved.

“I appreciate the thought of having some flexibility when it comes time to potentially vote for the debt exclusion on the high school and possibly have offsets from the effect of that, should it pass,” Sideris said. “We are taking a measure approach, rather than simply jumping into this.”

The current schedule would call for residents to vote on the WHS project debt exclusion in November 2021. The exact budget for the project has not been determined, but recent estimates would be from $196 million to $213 million. Watertown will also be reimbursed by the Massachusetts School Building Authority for close to half the amount of the cost.

Tax Bills

The average value of a home in Town is $733,688, and the tax bill on that property would be $6,741 for a home that gets the residential exemption, Smith said in his presentation to the Council on Tuesday (see the documents here). That would be an increase of $65.

For FY2021, the residential exemption reduces the residential property tax bills by by $2,247 per property, no matter the assessed value

A property assessed at $350,000 would have an annual tax bill of $2,041, while the bill for a home valued at $650,000 would be $5,716, and the owner of a home assessed at $950,000 would pay $9,391. (See the amount for other property values below).

The residential exemption also means that properties that are rented out, or are second homes, get taxes higher than they would be if there was no exemption. A home without an exemption valued at $650,000, for instance, would have a tax bill of $3,063.

Residents can apply for the residential exemption if their primary home is in Watertown, Smith said. They must live in the home on Jan. 1 of a given year to qualify for the exemption that year. Find out more about applying for the residential exemption on the Assessor’s website, by clicking here.

Councilor Angeline Kounelis she has been asking for the residential exemption to be increased to 25 percent for years to reduce the tax increase for homeowners. The exemption was 20 percent until FY2016, and was increased to 22 percent in FY2017, 23 percent in FY2018, and 24 percent in FY2020.

“Last year, the increase was 4.57 percent. This year if we accept 25 percent, with the 1.75 shift (to commercial properties), the increase will be 0.97 percent,” Kounelis said. “(That is) something that area residents have been looking for, for a very long time. I constantly hear from residents that with all the growth going on and congestion, what are the residential property owners reaping from this? We actually might see a little bit of relief for residential property owners.”

Smith noted that properties on the higher end of the range will not benefit from the residential exemption. Those are residential properties assessed at $1.195 million or more, he said.

“It starts to lose effect as you go higher,” Smith said. “You still get the residential exemption, but if you are assessed at more than $1.195 million, you pay a little bit more because if there was no residential exemption at all your tax rate would be lower.”

Shifting the Tax Burden

The Council also voted to again have a split tax rate, which shifts taxes 175 percent to the commercial properties in town, which is the maximum allowed in Massachusetts. The Town started doing this in FY2002.

Without the shift, all properties in Town would have a tax rate of $13.13. With the 175 percent shift, residential drops to $10.37 (before the residential exemption) and CIP goes to 22.98 percent, Smith said.

The same overall amount of property taxes is collected, $123.39 million. As a result of the shift, residential property owners pay $76.15 million in taxes, and CIP properties are taxed $47.2 million, which Smith said is $20.25 million more than before the shift.

The average commercial property assessment went up by $1.1 million, or 36 percent, but that is skewed by some major projects in Watertown, Smith said. The CIP tax rate rose 45 cents to $22.98, but the value of commercial properties increased by about $166 million from FY2020 to FY2021.

“Arsenal Yards this year went up $58 million in assessed value, and Arsenal on the Charles wen up $46 million in assessed value,” Smith said. “Those two alone went up $100 million — those two alone skew the commercial industrial (CIP) tax rate.”

Other properties that had large increased in assessed values include two buildings converted to biotech lab space, 65 Grove St. ($197,000) and 650 Pleasant St ($100,000), and the new self-storage facility at 80 Elm St. ($90,000), Smith said.

Councilor Ken Woodland said that Watertown has unusual conditions of doing both the tax shift and the residential exemption. About 100 communities in the State have the split tax rate, and Woodland said believes there are about a dozen of the 351 communities in Massachusetts to do both the shift and the exemption.

“Watertown in a unique situation where we even have the ability to do … the shift, where the CIP properties take more of the burden than the residential,” Woodland said. “You need a couple things — you need a commercial class that’s able to adopt this amount and you also need a growing commercial class, In both those situations you able to shift more money onto the commercial properties, and have the residential owners pay less of that burden.”

I found this report very sobering. I don’t if I am one of those for whom the exemptions will fail to serve. However, eventually our property will hit that break-even point of assessed value, at which point exemptions brings diminishing returns.

Regarding our tenants, we do keep rents just under market value because it is not good business to gouge tenants. Eventually one runs out of good tenants and constantly turning over an apartment is costly, especially if one does not have the volume of units.

I sent an email to the town council, and City Council President Sideris and Councilor Bays got back to me right away. Councilor Bays assured me that the Auditor’s office would come up with some sort of relief for residents. Council President Sideris got me in touch with individuals at the Assessor Office. I am currently working with Sean and his manager Earl. I am very appreciative and hope that some additional exemptions apply. It is good to know our City Council understands how troublesome the economics here are. Thank you!