Charlie Breitrose Watertown’s City Hall.

Property taxes will rise nearly 6 percent over last year, but will still be lower than they were in Fiscal Year 2022 (2021-22).

On Tuesday, City Council approved a property tax rate with the maximum amount of the burden shifted from residential to commercial, industrial and personal properties, and the maximum residential exemption for owner-occupied homes. During the Property Tax Classification Hearing, the Council heard from people concerned about the rising taxes, as well as the recent five-year property revaluation process.

Tax Bills

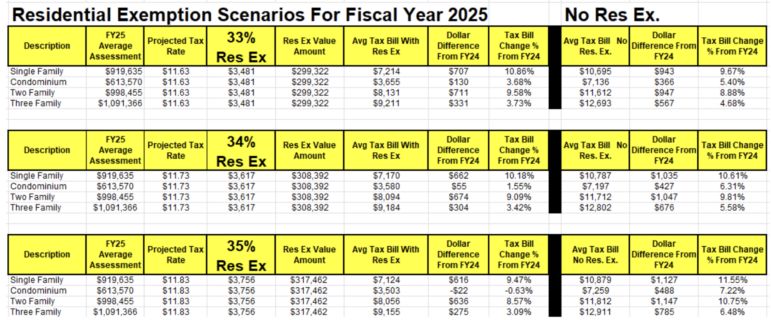

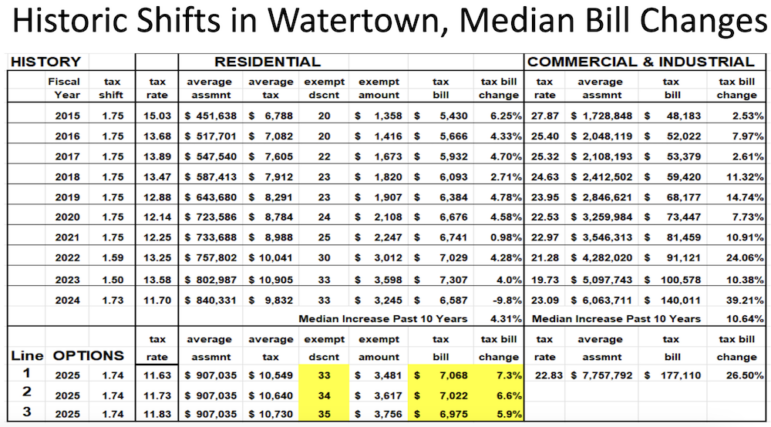

The Council got to choose the maximum exclusion for residential properties, either 33 percent (the same as last year), 34 percent, or 35 percent. The Board of Assessors policy has been to increase the maximum exemption if the increase is more than the 10 year median increase, which is 4.31 percent. If it was kept at 33 percent, the increase would be 7.3 percent.

The Board of Assessors did not make a recommendation this year, Smith said, because it did not have the information at the last meeting before the Tax Classification hearing. The Mass. Department of Revenue provided the certification of Watertown’s numbers the afternoon before Tuesday’s meeting.

“I don’t think any member of the Board of Assessors would have any issue with going to 35 percent,” said Smith, who is one of three members of the Board of Assessors.

With the 35 percent maximum shift for owner-occupied homes, the exemption removes $3,756 from the tax bill. The rate for the average single family home (valued at $919,635) is $7,124, which is up $616 or 9.47 percent. The average condo (valued at $613,570) is $3,503, a drop of $22 or 0.63 percent. The average two-family home (valued at $998,455) is $8,056, which is an increase of $636 or 8.57 percent.

Residential exemptions are available to people who own a property in Watertown, and use it as their primary residence. See more information by clicking here.

The Council approved the highest shift available to CIP (commercial, industrial and personal), 174.5 percent. Watertown Assessor Earl Smith said the Council has always shifted the most possible, which from FY04-21 was 175 percent. In FY22, Watertown hit a hiccup, because under state law residential taxpayers must pay the greater of 50 percent of the value share of overall city property levy or the lowest percentage share of the tax levy they have paid since classification began — which is 61.2 percent in Watertown’s case.

In October 2023, the Legislation was approved in the State House, and the governor signed it. This special legislation applies to Fiscal Years’ 2024, 2025 and 2026. The legislation allowed the maximum shift last year, which resulted in a drop in taxes of nearly 10 percent.

Controlling Taxes

The Council received comments from residents about controlling the property tax increases, including from former District A Councilor Angeline Kounelis who said it could be time to look at reducing spending.

Council Vice President Vincent Piccirilli said that while the taxes are rising 5.98 percent, the total average bill of $6.975 is smaller than it was in FY22 ($7,029) or FY23 ($7,307).

Typically, Watertown bases the budget on a 2.5 percent increase in the property taxes, the maximum allowed under Proposition 2 1/2. Added to that is the tax dollars that come in from new growth — new developments and improvements to properties.

City Manager George Proakis said that the time to discuss reducing taxes is when the budget is created. The Property Tax Classification reflects the budget amount passed in June when the Council approved the budget.

City Council President Mark Sideris said during the recent City Council Budget Priority Guideline hearings cutting the budget did not come up as one of the priorities.

“That would have been the time to say, ‘hey wait a minute, let’s take a look at this, maybe this isn’t the time to be adding.’ I think the Council needs to consider carefully before the manager makes his budget in the future that these are the ramifications,” Sideris said. “What we are doing tonight is basically what we voted for in June.”

Proakis gave an example of how reducing the budget would impact property owners. By cutting $1 million from the budget, Proakis said, the average homeowner would receive a $60 tax reduction. The biggest reductions would go to large commercial property owners, such as Alexandria Real Estate, Proakis said, which would get a reduction of about $100,000.

Next year, Fiscal Year 2026, may not lend itself to not taking the maximum 2.5 percent increase, Proakis said, however there are 11 approved lab buildings that would bring in around $2 million in new taxes each.

“If someone walked into my office and said we are ready to build three or four more lab buildings right now I think a serious conversation with this Council in fiscal years moving forward is worth having,” Proakis said.

Proakis said he is looking at other places where the City could reduce the burden on residential property owners. One area where he believes small property owners could see reductions is water and sewer rates.

Revaluation

The City went through a five-year certification this year, which included property revaluation. Smith had help from a consultant to look at all the different types of properties, including single-family, condos, two-families, multi-families, as well as types of homes, such as colonials, Capes, etc. They look at the prices that homes have sold.

Residents noted there are significant differences in the values of homes that are of the same type, or differences depending on where they are located.

The revaluation is based on “what the market is saying,” Smith said, who added that the biggest change has been seen in the lower valued single-family homes.

“In the lower end of the single family class, no body is building single families, they have become very sought after, there are a very limited number and going down in number, and we know there is not a tremendous amount of housing in the community, prices are going up, and (buyers) will pay,” Smith said. “And the lower end tier get the biggest bump because those are the most affordable to people, as opposed to the higher end.”

While the revaluation process has concluded, residents can still appeal and have City officials come into their home to see if the value can be changed. If they change the amount property owners would receive and abatement.

Sideris said if residents feel the tax bill is not correct, the deadline to apply for an abatement is Feb. 3, 2025.

Find out more about assessments and abatements by clicking here.